Managing your financial assets effectively includes planning for the future and ensuring your investments are properly transferred to your loved ones. TreasuryDirect accounts offer a secure way to purchase government securities directly from the U.S. Treasury. However, many investors overlook the importance of designating beneficiaries for these accounts. According to financial experts at Communal Business, proper beneficiary designation is crucial for estate planning and avoiding complications during asset transfer.

Setting up beneficiaries for your TreasuryDirect account ensures that your Treasury securities pass smoothly to your designated recipients upon your death. This process eliminates the need for probate court proceedings and provides peace of mind for both you and your family. Additionally, when you add beneficiary to treasurydirect account, you maintain control over who receives your investments while simplifying the transfer process.

The TreasuryDirect system allows account holders to designate both primary and contingent beneficiaries. This flexibility ensures that your assets are distributed according to your wishes, even if circumstances change over time. Furthermore, the beneficiary designation process is straightforward and can be completed entirely online through your TreasuryDirect account portal.

Understanding TreasuryDirect Beneficiary Options

TreasuryDirect offers several beneficiary designation options to meet different estate planning needs. Primary beneficiaries are the first individuals or entities that will receive your Treasury securities upon your death. These beneficiaries have the highest priority in receiving your assets.

Contingent beneficiaries, also known as secondary beneficiaries, receive your assets only if all primary beneficiaries have predeceased you or are unable to receive the inheritance. This backup system ensures that your investments don’t become part of your probate estate unnecessarily.

The system also allows for percentage allocations among multiple beneficiaries. For example, you might designate your spouse to receive 60% of your holdings and divide the remaining 40% equally between two children. This flexibility accommodates various family structures and personal preferences.

Step-by-Step Process to Add Beneficiaries

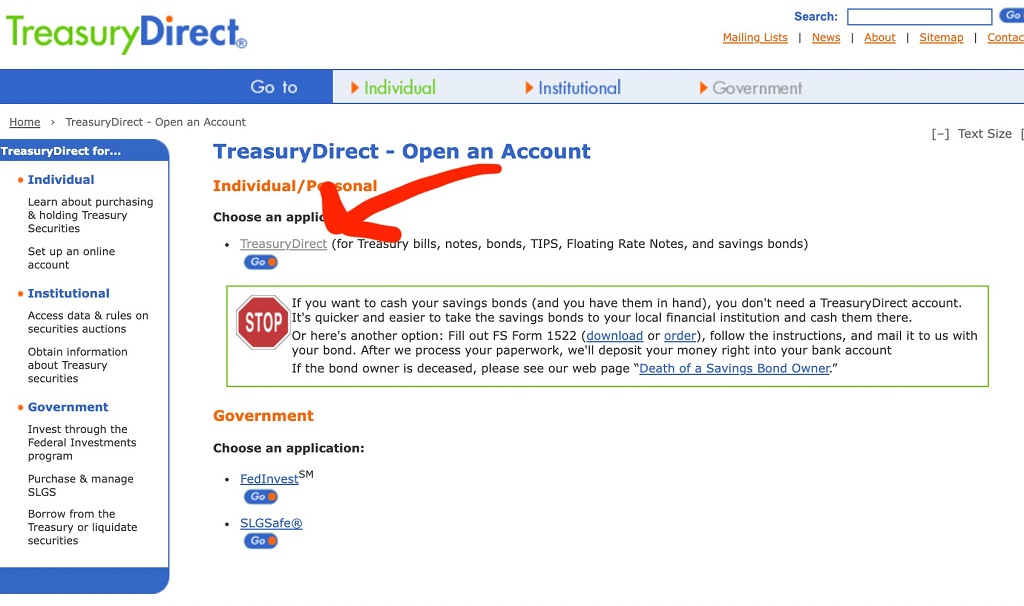

The process of adding beneficiaries to your TreasuryDirect account begins with logging into your online account. Navigate to the “Manage My Account” section, where you’ll find the beneficiary options clearly labeled. The interface is user-friendly and guides you through each step systematically.

First, you’ll need to provide basic information about each beneficiary, including their full legal name, Social Security number, and relationship to you. The system requires accurate information to prevent delays during the transfer process. Therefore, double-check all entered data before proceeding to the next step.

Next, you’ll specify the percentage of assets each beneficiary should receive. The total must equal 100% for primary beneficiaries. If you’re also designating contingent beneficiaries, their percentages must also total 100% separately. The system automatically calculates these percentages to prevent errors.

After entering beneficiary information, you’ll review all details on a confirmation screen. This step allows you to verify that all names, Social Security numbers, and percentages are correct. Once you confirm the information, the system processes your beneficiary designations immediately.

Required Information for Beneficiary Setup

Setting up beneficiaries requires specific documentation and information to ensure legal compliance. Each beneficiary must be identified with their complete legal name as it appears on official government documents. Middle names and suffixes should be included exactly as shown on Social Security cards or driver’s licenses.

Social Security numbers are mandatory for all individual beneficiaries. This requirement helps the Treasury Department verify identities and process transfers efficiently. However, if you’re naming a trust or organization as a beneficiary, you’ll need their Tax Identification Number instead.

You must also specify your relationship to each beneficiary. Common relationships include spouse, child, parent, sibling, or friend. For non-relatives, simply select “other” and provide a brief description if required. This information helps with administrative processing and potential tax implications.

Additionally, providing current addresses for all beneficiaries is recommended, though not always required during the initial setup. This information can expedite the notification process when transfers become necessary. Keep this information updated as beneficiaries relocate or change contact details.

Common Mistakes to Avoid

Many account holders make preventable errors when setting up beneficiaries for their TreasuryDirect accounts. One frequent mistake is failing to update beneficiary information after major life events. Marriage, divorce, births, and deaths all warrant immediate beneficiary reviews and updates.

Another common error involves incorrect percentage allocations. Some people attempt to designate more than 100% of their assets or leave gaps that don’t total 100%. The TreasuryDirect system prevents these mathematical errors, but it’s better to plan carefully from the start.

Failing to designate contingent beneficiaries represents a significant oversight. Without backup beneficiaries, your assets might end up in probate if primary beneficiaries predecease you. This situation can create unnecessary complications and expenses for your estate.

Many account holders also forget to consider tax implications when selecting beneficiaries. While TreasuryDirect doesn’t provide tax advice, consulting with a financial advisor about the tax consequences of your beneficiary choices is wise. Different beneficiary types may face varying tax treatments on inherited Treasury securities.

Updating and Managing Beneficiary Information

Regular maintenance of your beneficiary information ensures that your estate planning remains current and effective. TreasuryDirect allows you to modify beneficiary designations at any time without fees or penalties. This flexibility accommodates changing family circumstances and personal preferences.

To update existing beneficiary information, log into your account and navigate to the beneficiary management section. The system displays current designations clearly, making it easy to identify what needs changing. You can add new beneficiaries, remove existing ones, or modify percentage allocations as needed.

Life events that typically trigger beneficiary updates include marriage, divorce, the birth of children or grandchildren, and the death of designated beneficiaries. Additionally, changes in relationships or financial circumstances might influence your beneficiary choices. Therefore, reviewing your designations annually ensures they remain appropriate.

When updating beneficiary information, the changes take effect immediately upon confirmation. However, it’s good practice to print or save confirmation documents for your records. These documents provide proof of your beneficiary designations and can be valuable for estate planning purposes.

Estate Planning Benefits

Properly designated beneficiaries provide significant advantages for estate planning and asset transfer. Treasury securities with named beneficiaries transfer directly to recipients without going through probate court. This process saves time, reduces costs, and maintains privacy for your financial affairs.

The direct transfer mechanism also means beneficiaries can access inherited Treasury securities relatively quickly after your death. Instead of waiting for probate proceedings, which can take months or years, beneficiaries typically receive their inheritance within weeks of submitting required documentation.

Beneficiary designations also override will provisions in most cases. This legal principle means that your TreasuryDirect beneficiary designations take precedence over any conflicting instructions in your will. Therefore, keeping these designations current and aligned with your overall estate plan is crucial.

Furthermore, proper beneficiary planning can help minimize estate taxes in some situations. While Treasury securities themselves may be subject to federal estate taxes, the efficient transfer mechanism can reduce administrative costs and complexity for your estate.

Read More Also: How to Create a Stunning Purple Bathroom Decor Theme

Conclusion

Adding beneficiaries to your TreasuryDirect account is a straightforward process that provides substantial benefits for your estate planning. The online system makes it easy to designate both primary and contingent beneficiaries while maintaining the flexibility to update information as your circumstances change.

Proper beneficiary designation ensures that your Treasury securities transfer efficiently to your chosen recipients without unnecessary delays or complications. This planning step demonstrates care for your family’s financial future and reduces the administrative burden during already difficult times.

Remember to review and update your beneficiary information regularly, especially after major life events. By taking these simple steps, you can ensure that your TreasuryDirect investments align with your overall estate planning goals and provide security for your loved ones.

Read More Also: Aromatherapy Combinations for At-Home Spa Day

Frequently Asked Questions

Can I name multiple beneficiaries for my TreasuryDirect account?

Yes, TreasuryDirect allows you to designate multiple primary and contingent beneficiaries. You can specify what percentage of your assets each beneficiary should receive, and the total must equal 100% for each beneficiary category.

What happens if I don’t designate any beneficiaries?

If you don’t name beneficiaries, your TreasuryDirect assets will likely become part of your probate estate upon death. This means the securities will be distributed according to your will or state intestacy laws, potentially causing delays and additional costs.

Can I change my beneficiaries at any time?

Yes, you can update your beneficiary designations at any time through your online TreasuryDirect account. Changes take effect immediately upon confirmation, and there are no fees for making these updates.

Do beneficiary designations override my will?

In most cases, yes. Beneficiary designations on TreasuryDirect accounts typically take precedence over conflicting provisions in your will. This is why it’s important to keep your beneficiary information current and aligned with your overall estate plan.

What information do I need to provide for each beneficiary?

You’ll need each beneficiary’s full legal name, Social Security number (or Tax ID for organizations), your relationship to them, and the percentage of assets they should receive. Current addresses are also recommended for efficient processing.